how much federal tax is deducted from a paycheck in ma

Jan 12 2021 the tax rate is 6 of the first 7000 of taxable income an employee earns annually. Paycheck Deductions for 1000 Paycheck.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

. For annual and hourly wages. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Where Is My State Refund Ga. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The federal income tax has seven tax rates for 2020.

Sometimes employers take money out of your pay to pay themselves back for. In addition to federal income tax you will also have to pay state income tax and any other local income taxes like those for city or county governments. Youll use Federal Form W-4 to calculate how much federal income tax to withhold from your employees pay.

Your employer cannot decide to take other deductions out of your pay for any other reason. Contacting the Department of Unemployment Assistance to fulfill obligations for state employment security taxes. The total Social Security and Medicare taxes withheld.

For new employers the tax rate is 27 which is applied to the first 7000 in wages per employee a year. Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct such amounts of that income from their gross income if it is later determined that they. For unemployment insurance information call 617 626-5075.

Learn about the Claim of Right deduction. How much tax is deducted from a 1000 paycheck. Get ready today to.

Any amount over that is not subject to tax. Important note on the salary paycheck calculator. IR-2019-178 Get Ready for Taxes.

The only deductions your employer can take from your pay are deductions he or she must take and deductions you have agreed to. Income Tax Calculator California. The social security tax is 62 percent of your total pay until you reach an annual income threshold.

Your household income location filing status and number of personal exemptions. Jan 01 2020 when massachusetts income tax withheld is 500 or more by the 7th 15th 22nd and last day of a month pay over within 3 business days after that. For example an.

Its important to note that there are limits to the pre-tax contribution amounts. IR-2019-178 Get Ready for Taxes. Adjusted gross income - Post-tax deductions Exemptions Taxable income.

In this 09 more tax is deducted for Medicare purposes. Social security tax and medicare tax are two federal taxes deducted from your paycheck. Adjusted gross income - Post-tax deductions Exemptions Taxable income.

That goes for both earned income wages salary commissions and unearned income interest and dividends. Many range between 1 and 10. New employers pay 242 and new construction employers pay 737 for 2022.

Your employer must have your agreement in writing. These percentages are deducted from an employees gross pay for each paycheck. Your contributions to a tax-deferred retirement plan like a 401k plan should not be included in calculations for both federal income tax or Social Security tax.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Heres another example. How Income Taxes Are Calculated.

State sales tax rates in Florida are 600 percent local tax rates are 200 percent and the combined average of state and local sales taxes is 701 percent. State income tax rates tend to be lower than federal tax rates. If you make 10000 a year living in the region of California USA you will be taxed 885.

Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Our calculator has been specially developed in order to provide the users of the calculator with not. For annual and hourly wages.

Any deductions or increases made during the pay period. Employers also have to pay a Work Force Training Contribution of 0056 and a Health Insurance Contribution of 5. The calculator on.

AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. For a single taxpayer a 1000 biweekly check means an annual gross income of 26000.

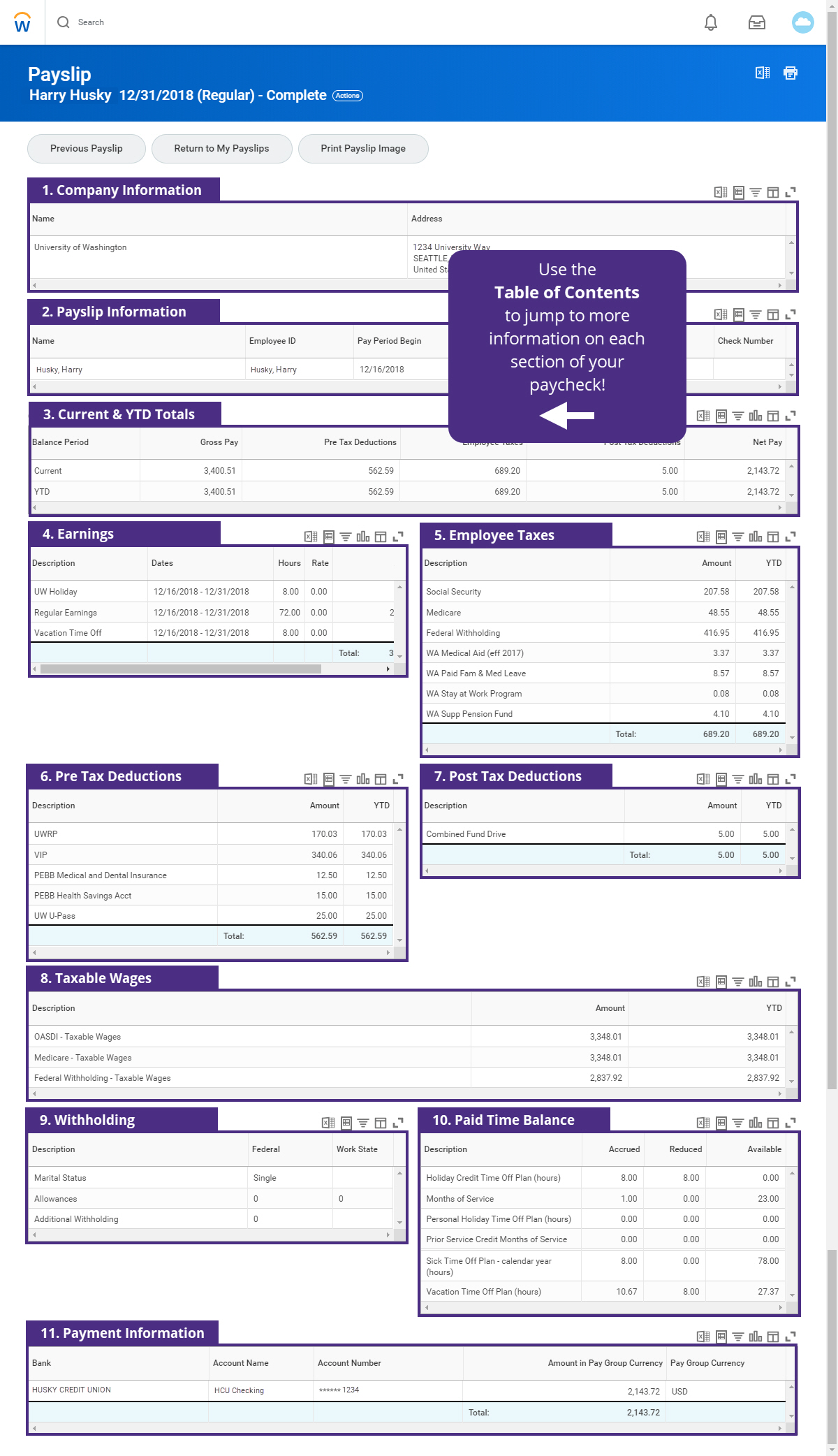

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. How Much Tax Is Deducted From A 1000 Paycheck. Total annual income - Tax liability All deductions Withholdings Your annual paycheck.

What is the massachusetts tax law. Paycheck Deductions for 1000 Paycheck Looking at a simple example can help clarify exactly how federal tax withholding works. Overview of Massachusetts Taxes.

How much tax is deducted from a paycheck in fl How much is payroll tax in Florida. Electronic pay stubs are allowed as long as the employee can print them out for free. Local Income Tax.

IRS Publication 15 Circular E pages 38-42 has a complete list of payments to employees and whether they are included in Social Security wages or subject. From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages. For a single taxpayer a 1000 biweekly check means an annual gross.

Massachusetts is a flat tax state that charges a tax rate of 500. Calculate your tax year 2022 take home pay after federal Massachusetts taxes deductions and exemptions. The amount of federal and Massachusetts income tax withheld for the prior year.

1 were not in fact entitled to the income and 2 have repaid the. Employees should complete this form when hired. Calculate your tax year 2022 take home pay after federal Massachusetts taxes deductions and exemptions.

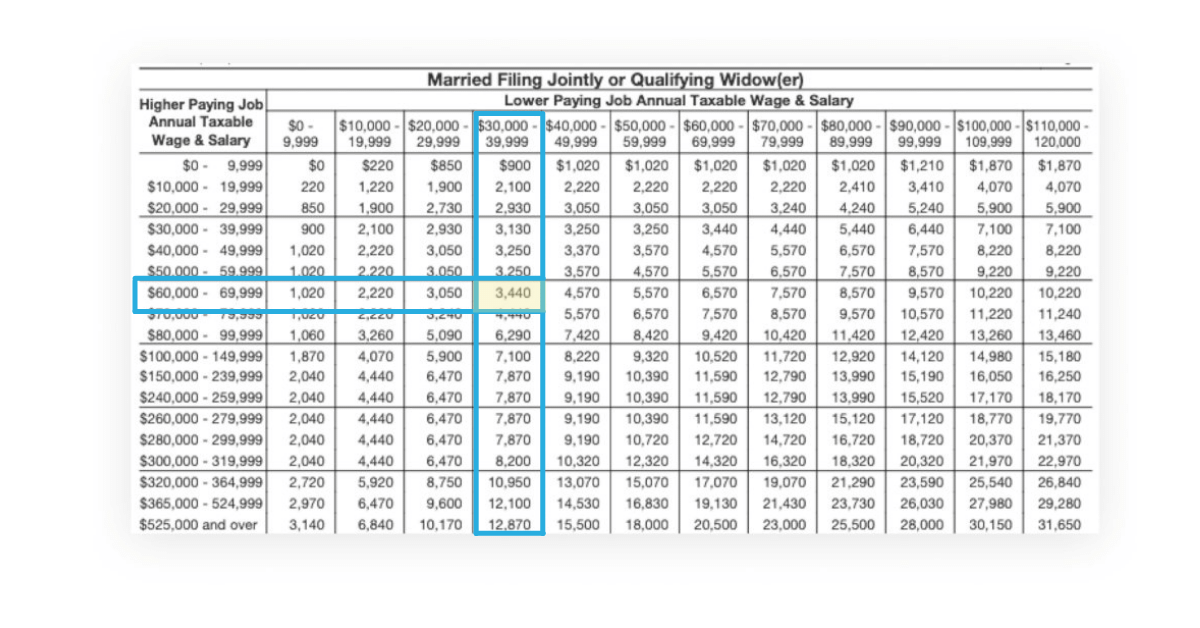

What Is The Federal Tax On 10000. For 2022 the limit for 401 k plans is 20500. If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes.

This tax is paid at the rate of 6 on the first 7000 earned by each employee in a year. If a resident of Georgia is earning more than 200000 then an additional tax is also applied on the paycheck called Medicare surtax. In 2022 if you are a new non-construction business you will pay an assigned rate of 242 for the first.

FICA and State Insurance Taxes. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223.

Take home pay for 2022 Its important to revisit your tax withholding especially if major changes from the tax cuts and jobs act affected the size of your. Taxable income Tax rate based on filing status Tax liability.

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Learn More About The Massachusetts State Tax Rate H R Block

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

How To Read Your Payslip Integrated Service Center

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

2022 Federal State Payroll Tax Rates For Employers

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Payroll And Tax Deductions Infographic Paycor Hr And Payroll Payroll Taxes Payroll Tax Deductions

Payroll And Tax Deductions Infographic Paycor Hr And Payroll Payroll Taxes Payroll Tax Deductions

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

Pay Stub Requirements By State Overview Chart Infographic

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business